Wiener is clearly not a fan, writing that Bitcoin is for “traders disconnected from the real moneymaking potential of stocks. “By my calculations investors lost money 45% of the time when they held Bitcoin for 10 days,” he wrote in an email on Monday. The range of five-day gains and losses, however, was enormous, with a high of 47% and a low of negative 29%. Dan Wiener, chairman of Adviser Investments and founder of the Independent Adviser for Vanguard Investors, analyzed Bitcoin’s price movements since the start of 2017 and found that the average five-day rolling return for Bitcoin was 1.5%. People who held Bitcoin for the entire period clearly did well, though one adviser found that Bitcoin has been a much trickier trade over shorter time spans during this period. The last time bitcoin surpassed that figure was on December 11, 2017. On Tuesday, it was trading near $6,500.Īn investor who bought at the start of 2017 would still be up more than 500%, dwarfing theĤ3% gain over that period. It fell 73% in 2018 and has risen 85% this year-but has not come close to retesting its previous highs. Since hitting its peak, however, Bitcoin has fluctuated wildly. It was the culmination of an incredible year for the digital currency, which had started 2017 at about $1,000. The study does not find evidence for Bitcoin being a safe haven investment.Two years ago today, Bitcoin hit its highest price ever, reaching $19,783. The interest of Bitcoin, measured by Google searches, has a positive, significant relationship with Bitcoin's price. Moreover, the volume of Bitcoin and Bitcoin's price has a significant, negative relationship. Our main finding and contribution is that political incidents and statements (“shocks”) are significant drivers of Bitcoin's price. The dependent variable is the Bitcoin price and the analysis has examined nine independent variables. The data includes 279 weekly observations from to (before the extreme development from the summer of 2017). To explain the price movements we have estimated two Autoregressive Distributed Lag models by using Ordinary Least Squares regression.

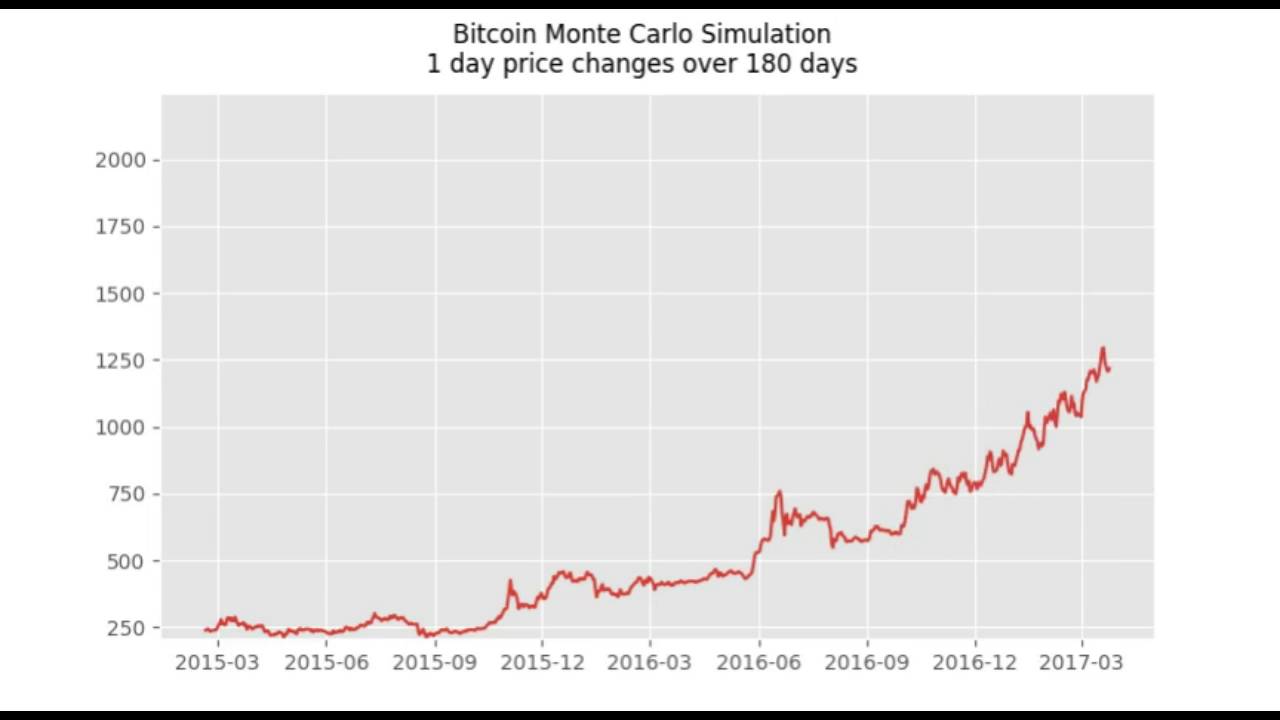

The price of the cryptocurrency Bitcoin is volatile and has increased from zero in 2009 to more than 19500 USD in December 2017.

The purpose of this study is to uncover factors that explain Bitcoin's price fluctuations. NTNU Business School, Norwegian University of Science and Technology

0 kommentar(er)

0 kommentar(er)